AFME is pleased to circulate the European Securitisation Data Snapshot for Q2 2024.

Key highlights:

Q2 2024 European Issuance

- In Q2 2024, EUR 66.6 bn of securitised product was issued in Europe, a decrease of 1.4% from Q1 2024 (EUR 67.6 bn) and a decrease of 30.4% from Q2 2023 (EUR 95.7 bn).

- Of this, EUR 45.4 bn was placed, representing 68.2% of the total, compared to EUR 32.0 bn placed in Q1 2024 (representing 47.4% of EUR 67.6 bn) and EUR 20.7 bn placed in Q2 2023 (representing 21.6% of EUR 95.7 bn).

- In Q2 2024, Pan-European CLOs led placed totals, followed by UK RMBS and German Auto ABS:

- Pan-European CLOs increased from EUR 11.6 bn in Q1 2024 to EUR 13.9 bn in Q2 2024;

- UK RMBS increased from EUR 9.2 bn in Q1 2024 to EUR 10.6 bn in Q2 2024; and

- German Auto ABS increased from EUR 3.1 bn in Q1 2024 to EUR 3.2 bn in Q2 2024.

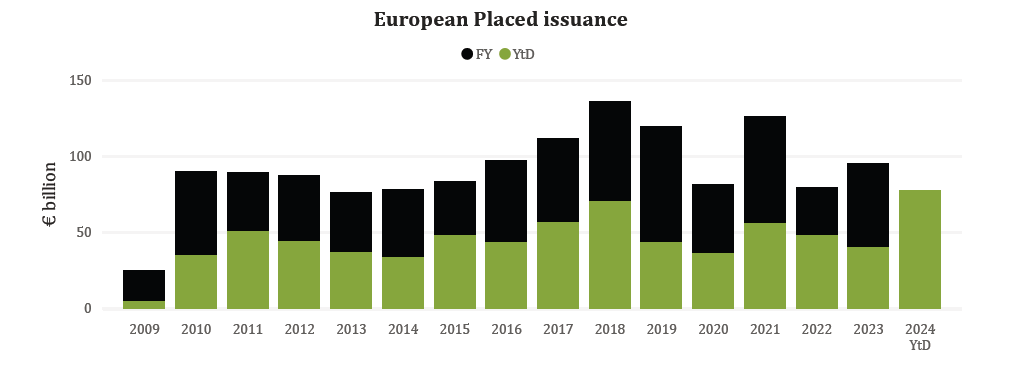

H1 Trends in European Placed Issuance and Geographic Breakdown

- In 2024H1, EUR 26.8 bn of placed securitised product was issued in the EU, EUR 25.2 bn in the UK and EUR 25.5 bn in Pan European CLOs, an annual increase of 74.7% (from EUR 15.2 bn), 91.3% (from EUR 13.2 bn) and 123.7% (from EUR 11.4 bn) respectively, compared to 2023H1

- However, since 2015, sustained growth in H1 issuance has remained low, with placed securitised volumes issued in the first half of the year in the EU increasing 3.2% on average in 2020-2024 compared to 2015-2019. Placed H1 issuance decreased by 7.9% in the UK and 6.0% for Pan European CLOs across the same period (namely 2020 – 2024). Consequently, the issuance trend in the EU (ex-CLOs) over the last 10 years is of marginal growth, as shown by the corresponding chart. In the UK, the most recent large increase in 2024H1 was partially driven by refinancings, specifically within the UK NC RMBS segment, where refinancings made up 73% (EUR 7.7 bn) of issued volumes in 2024H1.