AFME is pleased to circulate its Equity Primary Markets and Trading Report for the second quarter of 2022 (Q2 2022).

The report provides an update on the performance of the equity market in Europe in activities such as primary issuance, Mergers and Acquisitions (M&A), equity liquidity structure, and market valuations.

Key findings:

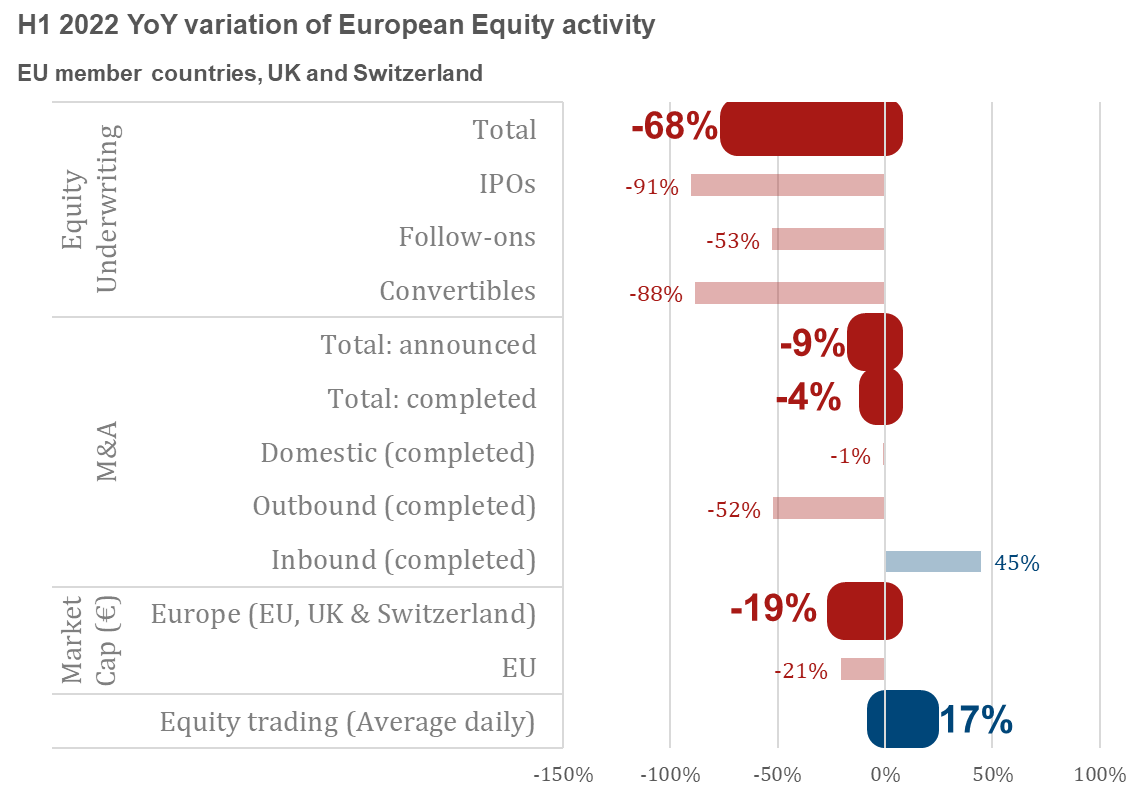

- Equity underwriting on European exchanges declined 68% in H1’22 compared to the first half of 2021. This represented the lowest H1 amount on records (since our records began in 2000).

- All forms of equity capital raising declined during the first half of the year compared to H1’21.

- IPO activity has continued exceptionally weak, in Europe and globally, with a 91% YoY decline on European exchanges (about the same percentage decline on US exchanges).

- SPAC IPOs totalled €1.4bn in H1’22, representing 36% of total IPO volume (11% in 2021, 3% in 2020).

- Completed Mergers and Acquisitions (M&A) in H1’22 declined when measured as announced value (-9% YoY) and when measured as completed value (-4% YoY).

- Inbound M&A has been the exception to a weak year for European M&A, with an annual increase of 45%.

- De-SPACS represented 3% of the total M&A value announced during H1’22, below the proportion observed during 2021FY (5%).

- Average daily equity trading on European main markets and MTFs stood at €96.7bn in Q2’22 and accumulates a 17% increase compared to the first half of 2021.

- Double Volume Cap (DVC) update: The number of instruments suspended under the DVC has recently declined to 615, from 838 in April 2022.

- By geographical location, 94 of the 615 suspended instruments have EU ISINs (or 15% of the total number of suspended instruments), 368 have UK ISINs (60% of suspensions) and 153 from the rest of the world (or 25% of suspensions).

- European equity trading mix: According to BigXYT data, on-venue trading represented 72% of the total addressable liquidity in Q2’22. Volume traded off-venues, on systematic internalisers and pure OTC, represent the remaining 28% of the volume of the total addressable liquidity.