Key highlights:

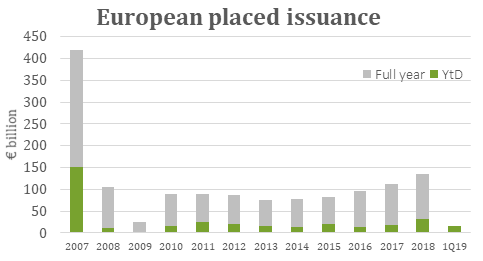

- In Q1 2019, EUR 32.4 bn of securitised product was issued in Europe, a decrease of 63.3% from Q4 2018 (EUR 88.4 bn) and a decrease of 44.6% from Q1 2018 (EUR 58.5 bn)

The delay in approval by the EU public authorities of key elements of the new securitisation framework was a relevant factor behind the significant issuance decline during the quarter.

However, in March, the European securitisation market saw the first transaction aimed to be compliant with the new STS regime, with further STS-compliant transactions currently in the pipeline. In April, the first public SONIA benchmarked RMBS transaction was marketed and notified to ESMA. This transaction is also the first UK STS compliant securitisation.

- Of the issued amount during Q1 2019, EUR 16.5 bn was placed, representing 50.9% of the total, compared to EUR 35.2 bn placed in Q4 2018 (representing 39.8% of EUR 88.4 bn) and EUR 32.2 bn placed in Q1 2018 (representing 55.0% of EUR 58.5 bn).

- In Q1 2019, PanEuropean CLOs led placed totals followed by UK Residential Mortgage-Backed Securities (RMBS) and UK Auto ABS.